How to Check Import Duties in 2023: A Comprehensive Guide

Navigating the world of import duties can be complex and time-consuming. However, in 2023, the process has been simplified and streamlined, allowing businesses and individuals to check import duties with ease. Here's a step-by-step guide to help you understand how to find the import duties for your specific products and targeted countries.

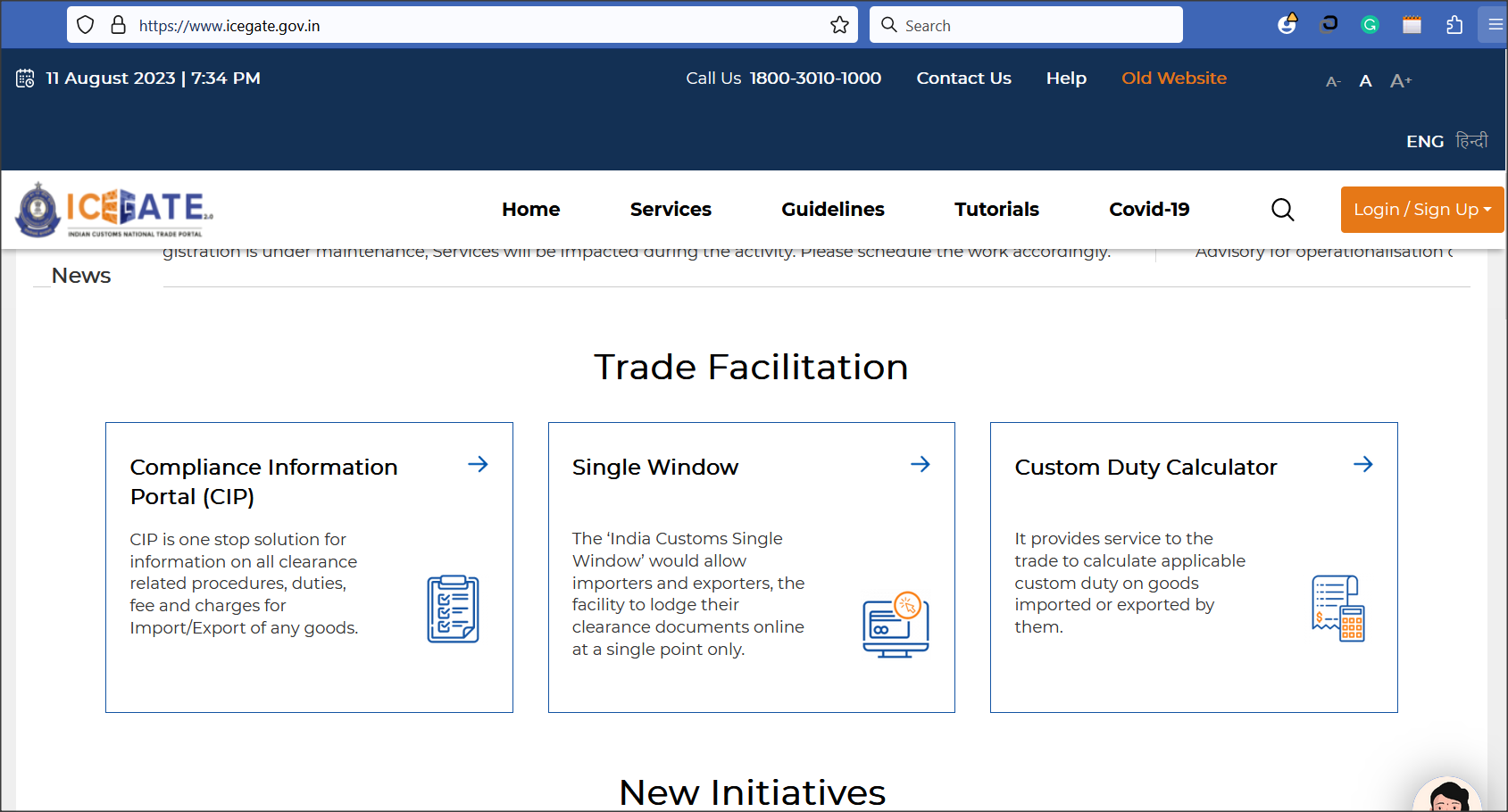

Step 1: Visit Custom Duty Calculator

Begin by visiting the official government portal at ICEGATE. This is a valuable resource for anyone engaged in international trade, providing access to a variety of tools, including the Custom Duty Calculator.

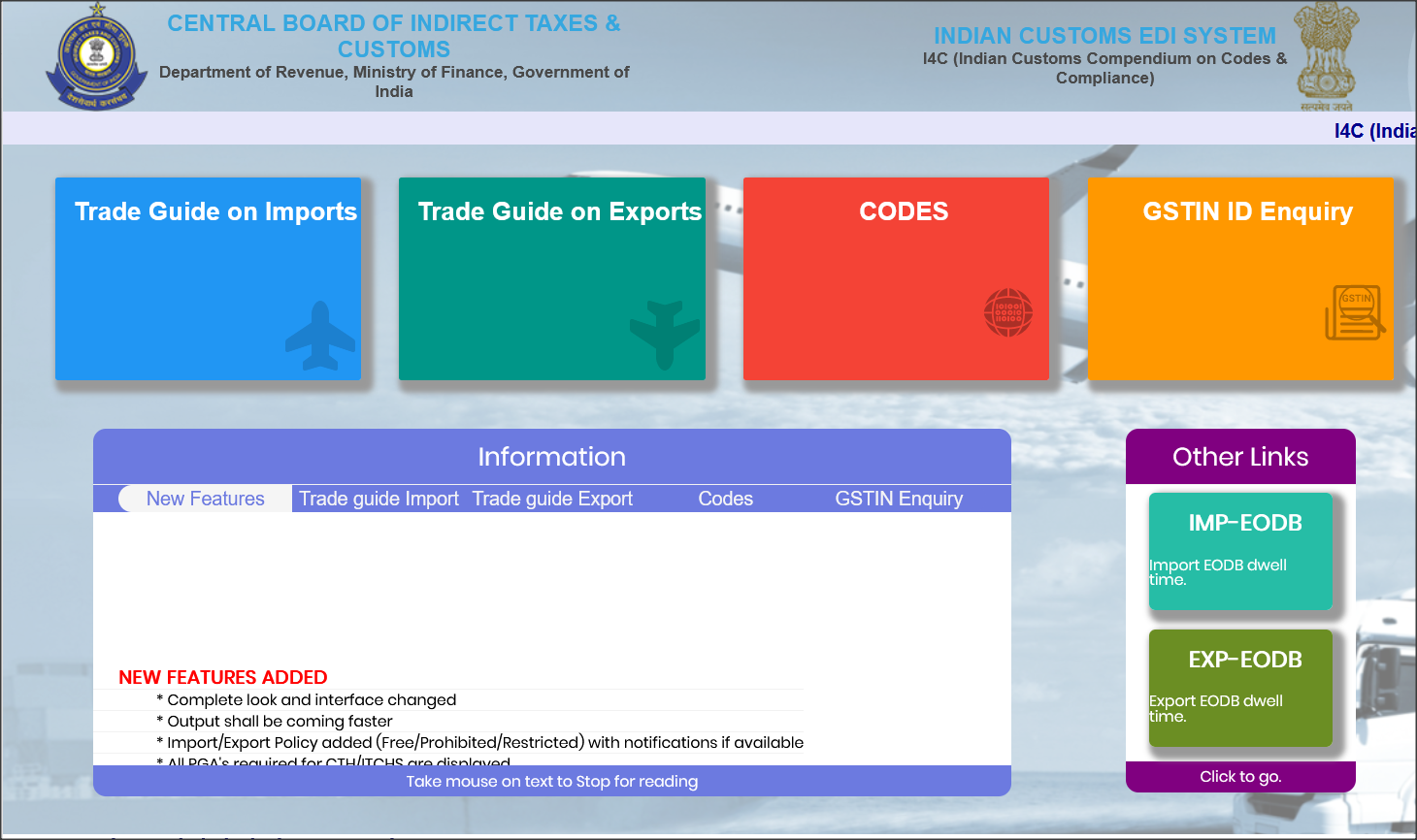

Step 2: Click Trade-Guide-on-Imports

Once on the website, navigate to the "Trade-Guide-on-Imports" section. This will direct you to the area where you can input information about the products you are interested in importing.

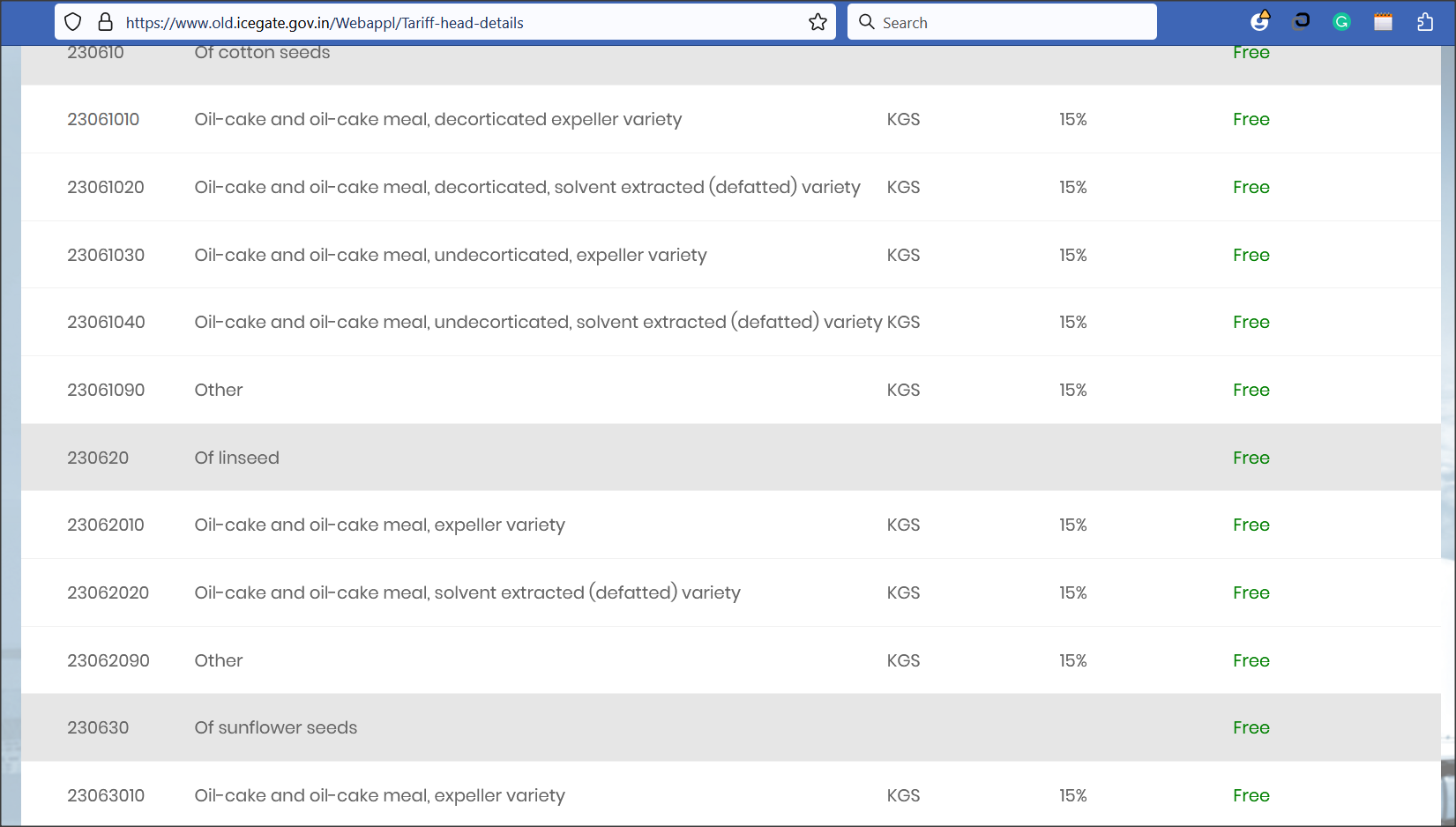

Step 3: Enter Product's HS Code or Description

You'll need to enter either the Harmonized System (HS) code or a description of the product you're importing. This information is essential to ensure that the correct duties are calculated.

Step 4: Click and Choose from HS Code

Based on the information entered, you'll be provided with a list of HS codes that match your description. Click and choose the relevant code to proceed.

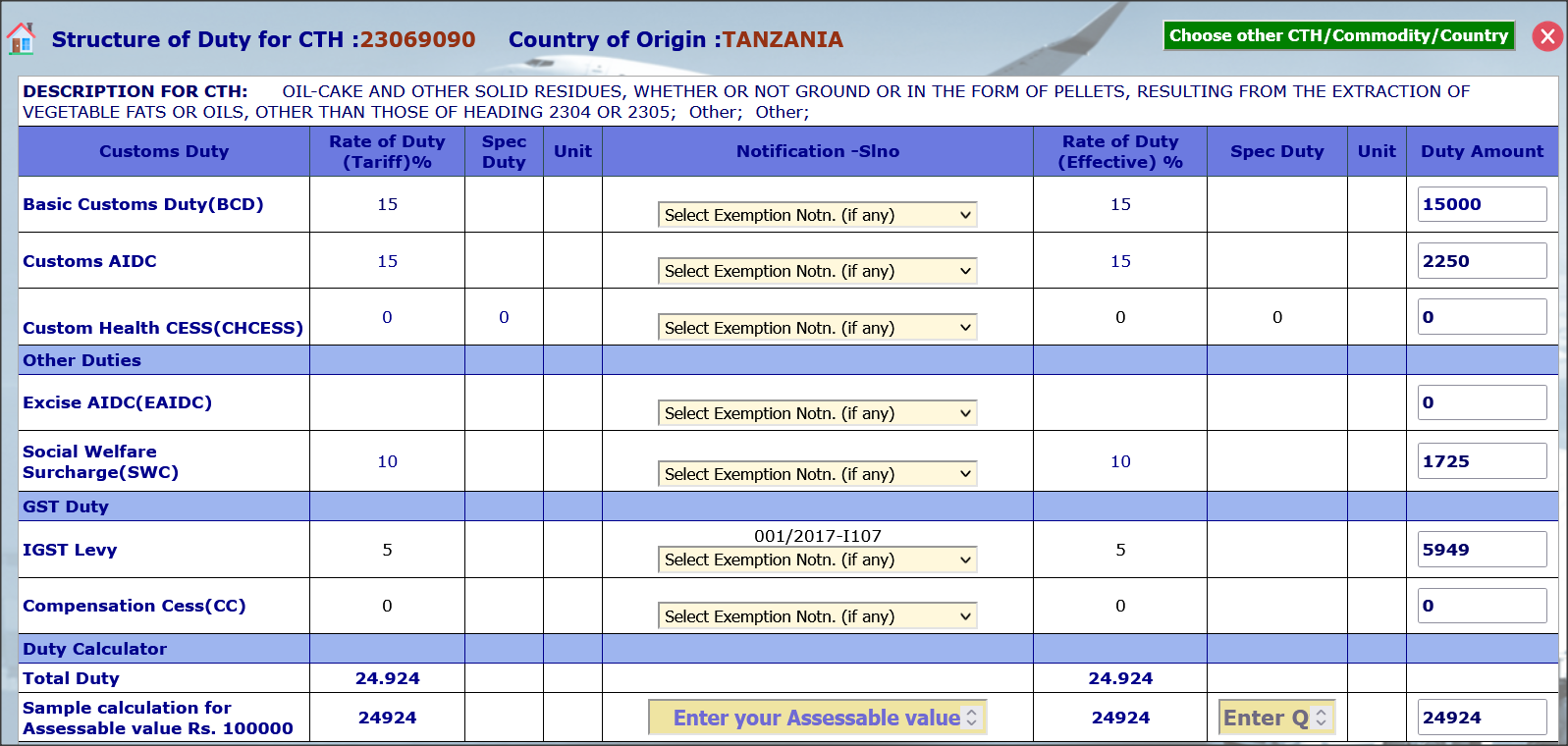

Step 5: Find the Duties

Once you've selected the appropriate HS code, the system will display the specific import duties for the product and target country you've chosen. Make a note of these, as they'll be integral to your costing.

Step 6: Review Additional Resources

Don't forget to check the Essential Checklist Before Importing. This checklist, provided by Barai Overseas Export Import Consultation, offers a wealth of information to help you understand the compulsory compliance requirements for import and evaluate the perfect import costing.

Essential Practical Inquiries to Consider

- Have you verified the HS code for accuracy and relevancy?

- Are you aware of the specific compliance requirements for your targeted country?

- Have you considered all the additional costs associated with importing, such as taxes and handling fees?

- How are you ensuring that you adhere to all legal and regulatory guidelines for importing into the desired country?

- Have you consulted with an experienced import-export professional to evaluate your overall import strategy and costing?

These inquiries are crucial to ensure that your import process is seamless and in accordance with all relevant laws and regulations.

How Barai Overseas Can Assist You

At Barai Overseas, we are committed to assisting our clients in navigating the complexities of import duties and compliance. Our tailored consultation services ensure that you are well-informed and prepared, allowing you to make sound decisions in your import endeavors. By leveraging our insights and expertise, you can attain a prosperous experience in the field of Export and Import.

For more resources and support, visit Export Import Guru.