India–US Tariff Tensions: What’s Really at Stake for Exporters?

Introduction

If you’ve been following the news, you’ve probably seen the alarming headlines: the United States is raising tariffs on Indian goods to a staggering 50%, effective from August 27, 2025. At first glance, this looks like a devastating blow to India’s export market. But here’s the truth — not all exports are equally affected. In fact, a significant portion of India’s trade with the U.S. remains safe from these hikes.

In this blog, we’ll break down the tariff announcement, analyze which sectors are hit, highlight those that are protected, and explore how exporters can strategically respond. We’ll also answer the top 10 FAQs Indian exporters are asking today. Let’s dive in.

Quick Snapshot: India–US Trade Relationship

The U.S. is India’s largest export destination, accounting for nearly 18% of India’s total global exports. In 2024:

- Goods exports to the U.S. = $87.3 billion

- Services exports to the U.S. = $41.6 billion

- Combined exports = $128.9 billion

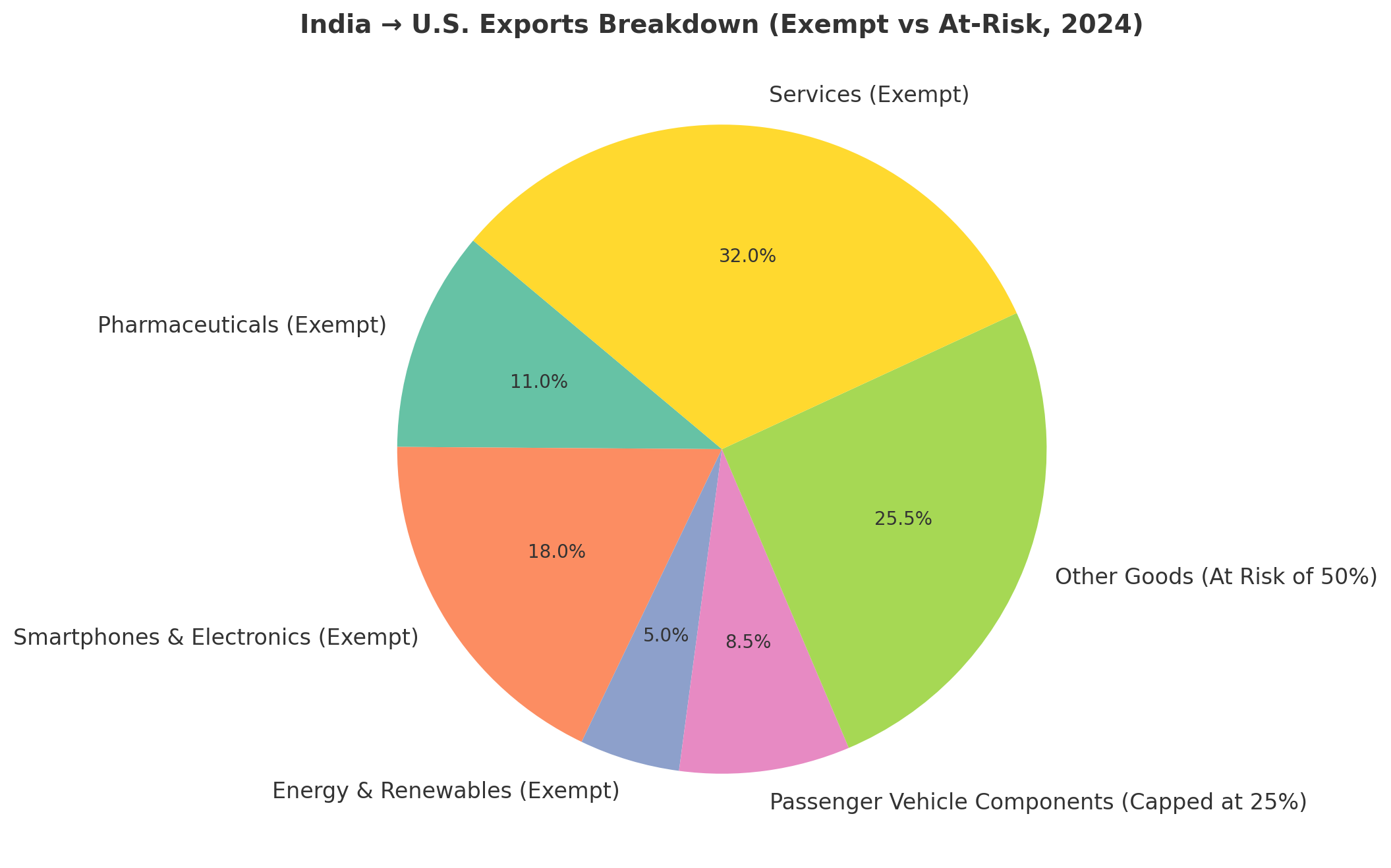

Services such as IT, software development, and consulting form almost 32% of this trade relationship, while goods account for about 68%. This mix is crucial when assessing the impact of tariffs.

The Tariff Announcement – What Changed

1. The Decision (Date & Announcement)

On August 6, 2025, the U.S. administration officially announced that tariffs on Indian goods would rise from 25% to 50%. This means that for certain Indian goods shipped to the U.S., importers will now pay half of the product’s value as customs duty at U.S. ports.

This is one of the highest tariff rates the U.S. has applied to a major trading partner in recent times, especially outside of a declared trade war (like the U.S.–China case).

2. Effective Date

The tariff increase is not immediate. Instead, the U.S. gave a 21-day window before implementation, making the effective date August 27, 2025.

- This short buffer allows importers and exporters to either rush shipments before the deadline or renegotiate contracts with new cost implications.

- Practically, shipments arriving before August 27 will be charged at the old 25% rate, but those cleared through customs on or after August 27 will attract the full 50%.

This creates a temporary surge in export activity as companies try to beat the deadline.

Which Sectors Are Exempt or Protected?

1. Pharmaceuticals – Fully Exempt

- Current status: Indian pharmaceutical exports to the U.S. are worth ~$8–9 billion annually.

- Why exempt?

-

- Critical for U.S. healthcare: Nearly 40% of generic medicines used in the U.S. are supplied by Indian companies.

- The U.S. depends heavily on India for affordable generics like antibiotics, cancer drugs, and cardiovascular medicines.

- Applying a 50% tariff here would raise healthcare costs for millions of Americans, which is politically and socially unacceptable.

- Baseline tariff: Most formulations already attract 0% MFN duty in the U.S., meaning they are duty-free under normal trade rules.

- Impact: Pharma continues to be a safe zone for Indian exporters, unaffected by tariff escalation.

2. Smartphones & Electronics – Exempt

- Current status: India exported $14.6 billion worth of electronics to the U.S. in 2024, with $10.5 billion coming from smartphones alone.

- Why exempt?

-

- Apple & U.S. supply chains: Apple and other global companies have been shifting production to India as part of the “China+1” strategy. Tariffs on Indian electronics would hurt U.S. companies’ own supply chains.

- Consumer electronics demand: The U.S. market relies heavily on imported smartphones and devices; adding tariffs here would raise costs for American consumers.

- Baseline tariff: Most finished smartphones already enjoy 0% duty, though some components may face 2–4% MFN duty.

- Impact: India’s booming smartphone and electronics export industry remains fully shielded from the new tariffs, reinforcing India’s position as a rising global electronics hub.

3. Energy & Renewables – Exempt

- Current status: This includes exports of solar panels, wind turbine parts, lithium-ion batteries, and inverters, which are steadily growing. India also exports refined petroleum products to the U.S. worth over $2 billion annually.

- Why exempt?

U.S. clean energy goals: The Biden administration (and even beyond) has strong renewable energy commitments. Imposing tariffs on solar modules or batteries from India would slow the U.S. transition to green energy.

Strategic alignment: The U.S. wants to reduce dependence on China for renewable energy components. India is seen as a strategic alternative supplier.

- Baseline tariff: Many renewable energy components already attract low or zero MFN duties.

- Impact: India’s renewable energy exports are fully protected, giving exporters an opportunity to expand their market share in the U.S. as Chinese dominance faces scrutiny.

4. Passenger Vehicle Components – Protected with a Cap

- Current status: India exported $6.8 billion worth of auto components to the U.S. in 2024. Passenger vehicle parts make up a significant share.

- Why capped at 25% (not 50%)?

-

- U.S. auto industry reliance: American auto manufacturers source affordable components from India to reduce costs. Raising tariffs to 50% would disrupt supply chains and increase car prices in the U.S. market.

- Balanced approach: By keeping passenger vehicle components at 25%, the U.S. maintains pressure but avoids harming its own automakers.

- Commercial vehicle parts: These do face the full 50% tariff, because they are less critical to U.S. consumer markets.

- Impact: Passenger vehicle component exporters retain a competitive foothold, though margins may still feel pressure at 25%.

Why These Exemptions Matter

- Combined, these protected sectors account for over one-third of India’s goods exports to the U.S. (~37–38%).

- When you add in services (like IT exports, also unaffected), more than half of India’s U.S. export market (~58%) remains safe.

- This is why the tariff hike, while headline-grabbing, doesn’t translate into a full-blown crisis for India’s overall trade.

The U.S. has deliberately spared critical sectors like pharma, electronics, renewables, and key auto parts because of mutual interdependence. India gains continued access to the U.S. market in these high-value categories, while the U.S. avoids disruption in healthcare, electronics supply chains, clean energy, and auto manufacturing.

How Big is the Unaffected Share?

1. Goods-Only View (Merchandise Exports)

- In 2024, India exported $87.3 billion worth of goods to the U.S.

- Out of this, the exempt or protected categories (Pharmaceuticals, Electronics, Energy & Renewables, Passenger Vehicle Components) together make up about 37–38%.

Breakdown:

- Pharmaceuticals → ~11% of goods exports (≈ $8.7B)

- Smartphones & Electronics → ~18% of goods exports (≈ $14.6B)

- Energy & Renewables → ~5% (≈ $4.4B, conservative estimate since renewables data is fragmented)

- Passenger Vehicle Components (capped at 25%) → ~8.5% (≈ $6.8B)

Total unaffected goods = ≈ $32.7 billion

- That’s roughly 37–38% of $87.3B goods exports.

Meaning: Even though tariffs are doubling, over one-third of goods exports remain untouched.

2. Goods + Services View (Full Trade Picture)

Now let’s add services, which are a huge part of India’s U.S. exports and completely untouched by tariffs.

- Services exports in 2024 = $41.6B (includes IT, consulting, financial services, BPO, etc.)

- Since tariffs do not apply to services, this entire figure is safe.

So:

- Unaffected goods = $32.7B

- Services (100% unaffected) = $41.6B

- Total unaffected exports = $74.3B

Now compare with total trade (goods + services) = $128.9B.

$74.3B ÷ $128.9B ≈ 57.7% (≈ 58%)

Meaning: When you consider the whole picture of India–U.S. trade, nearly three-fifths of exports remain fully safe.

3. Dollar Value Perspective

- At risk (tariff-affected exports) ≈ $54.6B

- Safe/unaffected exports ≈ $74.3B

That’s a very important distinction because the headlines make it sound like all $87B in goods trade is under fire, when in reality, more than half the total India–U.S. trade (goods + services) is shielded from tariffs.

4. Why This Matters

- Pharma & IT dominance: These are India’s strongest sectors in the U.S. and are safe from tariffs.

- At-risk sectors: Textiles, gems & jewelry, leather — important but smaller in total share compared to IT and pharma.

- Investor confidence: Shows that India’s U.S. trade partnership remains stable, not collapsing.

- Exporter strategy: Helps businesses prioritize exempt sectors and adapt in at-risk areas.

.png)

Here’s a side-by-side stacked bar chart comparing the share of unaffected vs at-risk exports in India–U.S. trade:

- Goods Only: ~37.5% unaffected, ~62.5% at risk.

- Goods + Services: ~58% unaffected, ~42% at risk.

This clearly shows how adding services into the picture dramatically improves India’s resilience to U.S. tariff hikes.

What Sectors Are Most at Risk?

The tariff hike to 50% is not universal — it targets traditional, labor-intensive, and price-sensitive sectors where India has strong competitiveness but also where U.S. producers (or alternative suppliers) are lobbying for protection.

Here’s the detailed look:

1. Textiles and Garments

- Size of exports: India exported $18.6 billion worth of textiles and apparel to the U.S. in 2024 (nearly 21% of total goods exports).

- Why targeted?

- The U.S. views textiles as a politically sensitive sector because it directly affects American manufacturing jobs.

- India’s advantage in low-cost cotton garments and home textiles (like sheets, towels) puts pressure on U.S. domestic producers.

- Impact of 50% tariff:

- A huge cost escalation that could price Indian textiles out of the U.S. market.

- Buyers may shift orders to Vietnam, Bangladesh, or Mexico, which already enjoy preferential trade agreements with the U.S. (e.g., USMCA for Mexico).

- Result: Many Indian exporters are already reporting order suspensions, cancellations, or renegotiations at lower prices.

2. Gems & Jewelry

- Size of exports: India exported $11.2 billion in gems and jewelry to the U.S. in 2024, making the U.S. one of the largest markets for Indian polished diamonds.

- Why targeted?

-

- Gems are a luxury category, meaning demand is price-sensitive but not “essential.”

- The U.S. can easily switch to suppliers in Thailand, Hong Kong, or domestic cutting centers if costs from India rise.

- Impact of 50% tariff:

-

- A 50% duty could make Indian polished diamonds and gold jewelry significantly more expensive, reducing competitiveness.

- The Indian diamond polishing industry, centered in Surat, may see a slowdown in U.S. orders.

- Result: Likely loss of U.S. market share in diamonds to competitors like Belgium and Israel.

3. Leather Goods and Footwear

- Size of exports: About $3.5 billion in leather products exported to the U.S. annually.

- Why targeted?

-

- The U.S. footwear and accessories industries are politically active, lobbying to protect their domestic share.

- India competes heavily with Vietnam, Indonesia, and Bangladesh, which already have strong FTA benefits with the U.S.

- Impact of 50% tariff:

-

- Indian leather bags, belts, footwear, and accessories could become uncompetitive overnight.

- Buyers are likely to shift orders to Vietnam and Bangladesh, which already dominate U.S. footwear imports.

- Result: A serious blow to Indian SMEs and artisans in the leather export sector.

4. Certain Auto Components (Especially Commercial Vehicle Parts) ??

- Size of exports: Auto components to the U.S. total about $6.8 billion, of which commercial vehicle parts form a significant chunk.

- Why targeted?

-

- Passenger vehicle components were capped at 25% duty, but commercial vehicle components face the full 50% tariff.

- The U.S. auto lobby pushed for this because they see India as a competitor in low-cost, heavy-duty auto parts.

- Impact of 50% tariff:

-

- Commercial auto parts (like truck engines, suspension systems, chassis components) will see steep cost increases.

- U.S. auto manufacturers may shift sourcing to Mexico (advantage under USMCA) or domestic suppliers.

- Result: Reduced Indian competitiveness in the heavy-duty vehicle segment, though passenger car parts remain relatively safe.

Wider Consequences for At-Risk Sectors

- Order cancellations & renegotiations: U.S. buyers are already scaling down or demanding lower prices.

- Supply chain disruption: Exporters face uncertainty, leading to reduced production and possible layoffs in labor-heavy industries like textiles and leather.

- Global competition: Countries like Vietnam, Bangladesh, and Mexico stand to gain market share from India due to preferential U.S. trade agreements.

- SMEs hit hardest: Unlike large corporations, small and medium exporters lack the resources to re-route trade or absorb high tariff shocks.

Case Study: Textile Exporter from Tiruppur

Rajan, a mid-sized exporter from Tiruppur, recently reported that his U.S. buyers paused orders after the tariff announcement. His strategy? Diversifying into the EU market while simultaneously working with logistics providers to explore third-country routing. This proactive approach is helping him soften the blow and retain some of his U.S. clients.

Strategies to Minimize Tariff Impact

1. Cross-Border Trade (Switch BL, Re-export)

- How it works: Instead of exporting directly from India to the U.S., goods can be shipped to an intermediary country (like Mexico, Vietnam, Singapore, or UAE) and then re-exported to the U.S.

- Switch Bill of Lading (BL): This is a trade tool that allows exporters to change shipping documents at the intermediary port, masking the original origin country in certain legitimate scenarios.

- Why effective?

-

- Countries like Mexico (under USMCA) enjoy duty-free or preferential tariff access to the U.S. market.

- Vietnam and some ASEAN countries also benefit from lower U.S. tariffs.

- Risks/Limitations: Must comply with rules of origin — if a product is only “transshipped” without significant processing, it could still attract the 50% duty. Proper documentation is critical to stay legal.

- Benefit: Helps bypass high tariffs and maintain competitive pricing in the U.S. market.

2. Market Diversification

- What it means: Instead of depending heavily on the U.S. (India’s single largest export destination), exporters should target alternative markets like:

-

- European Union (EU)

- Middle East (UAE, Saudi Arabia)

- ASEAN countries (Singapore, Malaysia, Indonesia, Thailand)

- Africa (South Africa, Nigeria)

- Why effective?

-

- Many of these regions have growing consumer markets and less tariff volatility compared to the U.S.

- India already has or is negotiating Free Trade Agreements (FTAs) with some of these partners (e.g., India–UAE CEPA, India–EU FTA in progress).

- Benefit: Reduces over-reliance on a single market, spreading risk across multiple geographies.

3. Value Addition

- What it means: Instead of exporting raw or basic goods that face steep tariffs, exporters can move up the value chain by exporting finished, high-end, or specialized products.

- Examples:

-

- In pharma, shift from bulk drugs (APIs) to finished formulations, which enjoy duty exemptions.

- In electronics, export assembled smartphones or high-tech components rather than generic parts.

- In auto components, focus on passenger vehicle parts (protected at 25%) instead of commercial vehicle parts (tariffed at 50%).

- Why effective?

-

- Higher-value products often fall in exempt or capped tariff categories.

- Allows exporters to absorb tariffs more easily since margins are higher.

- Benefit: Strengthens competitiveness and profitability despite tariffs.

4. Supply Chain Integration with U.S. Distributors

- What it means: Instead of simply exporting goods FOB (Free on Board), Indian exporters can partner with U.S.-based distributors, importers, or even set up local subsidiaries.

- Why effective?

-

- Tariff burden can be shared with U.S. buyers, making it less likely for them to switch suppliers.

- Indian companies setting up assembly or packaging units in the U.S. can sometimes bypass tariffs by qualifying products as “Made in USA.”

- Example: Several Chinese companies did this during the U.S.–China trade war by moving last-stage assembly to Mexico or the U.S. itself.

- Benefit: Maintains long-term buyer relationships and keeps India in the supply chain, even under tariff pressure.

5. Lobbying & Diplomacy

- What it means: Indian exporters, industry associations, and the Indian government can collectively push for tariff relief or exemptions.

- Why effective?

-

- Tariff escalation is politically driven, so government-to-government negotiation can lead to compromises.

- India may seek to leverage other areas of cooperation (like defense purchases or clean energy partnerships) to negotiate tariff rollbacks.

- Examples:

-

- During previous tariff disputes (e.g., India–U.S. steel tariffs), both governments entered talks and managed partial rollbacks/exemptions.

- Benefit: Medium-to-long-term policy solutions that can restore favorable trade terms.

No single strategy is enough. Exporters will likely adopt a blended approach:

- Short-term: Use cross-border routing and renegotiate contracts.

- Medium-term: Diversify markets and add value to exports.

- Long-term: Push for diplomatic solutions and deeper integration with U.S. supply chains.

Lessons from Global Trade Practices

- China–Vietnam model: Chinese companies often re-route exports through Vietnam to avoid tariffs.

- Mexico’s USMCA advantage: Many Asian exporters invest in Mexico to access the U.S. market tariff-free.

- India’s opportunity: Similar strategies can be adopted, but they must comply with rules of origin to remain legal.

FAQs – Top 10 Questions Exporters Ask:

- Does the 50% tariff apply to services like IT or consulting?

No. Tariffs are customs duties on goods only. Services are unaffected.

- When exactly will the new tariff come into effect?

On August 27, 2025.

- Are pharmaceuticals completely exempt?

Yes, most pharma exports will continue at 0% duty.

- What about smartphones and electronics — do all devices qualify?

Major segments like smartphones are exempt, though some components may still attract small MFN duties.

- How much of India’s total U.S. exports remain unaffected?

About 58% of combined goods and services trade.

- Can exporters legally use switch bills of lading to avoid tariffs?

Yes, provided it complies with rules of origin and proper documentation.

- Which Indian sectors are most at risk?

Textiles, gems & jewelry, leather goods, and certain auto components.

- How does this impact SMEs vs. large corporations?

SMEs are more vulnerable as they have less capacity to re-route or absorb costs.

- Could U.S. buyers shift sourcing away from India?

Yes, especially in textiles and gems, where alternatives like Vietnam or Bangladesh exist.

- What support can Indian exporters expect from the government?

Relief packages, market diversification initiatives, and possible diplomatic negotiations.

Conclusion

While the announcement of a 50% tariff on Indian goods is concerning, the bigger picture is far less dire. Nearly two-fifths of goods exports and over half of total exports (goods + services) remain safe. The impact is sector-specific, with textiles, gems, and leather most at risk. For others, especially in pharma, electronics, and IT services, the U.S. market remains wide open.

The way forward lies in strategic supply chain management, diversification, and diplomatic engagement. Exporters who innovate and adapt will continue to thrive, even in this challenging trade environment.

At Barai Overseas, we help exporters navigate tariff challenges, optimize cross-border logistics, and protect market share. If you want to secure your U.S. exports and explore tariff-smart strategies, connect with us today.

Chat with us directly on WhatsApp – [Click Here]

Discover more about us online – [Visit Now]

Learn More with BOAI – [CLICK HERE]

Tags: India US Tariff War Winners Losers and How Exporters Can Respond